PA DoR REV-1220 AS 2005 free printable template

Show details

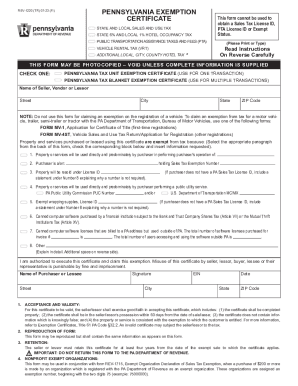

PENNSYLVANIA EXEMPTION CERTIFICATE REV-1220 AS 10-05 CHECK ONE COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF REVENUE BUREAU OF BUSINESS TRUST FUND TAXES PO BOX 280901 HARRISBURG PA 17128-0901 STATE OR LOCAL SALES AND USE TAX STATE OR LOCAL HOTEL OCCUPANCY TAX PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES PTA PASSENGER CAR RENTAL TAX PCRT This form cannot be used to obtain a Sales Tax License Number PTA License Number or Exempt Status. Please Print or Type Read Instructions On Reverse Carefully...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your pennsylvania exemption certificate rev form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pennsylvania exemption certificate rev form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pennsylvania exemption certificate rev online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pennsylvania exemption certificate rev. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

PA DoR REV-1220 AS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pennsylvania exemption certificate rev

How to fill out Pennsylvania exemption certificate rev:

01

Obtain the form: The Pennsylvania exemption certificate rev can be obtained from the Pennsylvania Department of Revenue's website or their local office.

02

Provide identification: Fill in the taxpayer's name, address, and taxpayer identification number (TIN) in the designated sections of the form.

03

Determine the exemption type: Select the appropriate exemption type from the provided options based on the reason for claiming exemption.

04

Provide supporting documentation: If required, attach any supporting documentation or evidence to substantiate the exemption claim.

05

Sign and date the form: The taxpayer or authorized representative must sign and date the exemption certificate rev.

06

Retain a copy: Make sure to keep a copy of the completed and signed exemption certificate rev for record-keeping purposes.

Who needs Pennsylvania exemption certificate rev:

01

Individuals or businesses making purchases in Pennsylvania: Anyone making purchases in Pennsylvania may need to provide a Pennsylvania exemption certificate rev to the seller to claim exemption from state sales tax.

02

Tax-exempt organizations: Nonprofit organizations and certain other entities recognized as tax-exempt by the Pennsylvania Department of Revenue must possess a valid exemption certificate rev to claim exemption from certain state taxes.

03

Resellers: Businesses that plan to resell the purchased goods or services generally require a Pennsylvania exemption certificate rev to avoid paying sales tax on their inventory.

Note: It is recommended to consult with a tax professional or the Pennsylvania Department of Revenue to determine the specific requirements and eligibility for obtaining and using the Pennsylvania exemption certificate rev.

Fill form : Try Risk Free

What is form pa rev 1220?

When should I use a REV-1220 PA Exemption Certificate? Exemption certificates are required to substantiate all tax exempt sales, except vehicles. The purchaser gives the completed form to the seller when claiming an exemption on Sales Tax.

People Also Ask about pennsylvania exemption certificate rev

How long is a Texas exemption certificate good for?

How do I get a PA sales tax exemption certificate?

Who is exemption from hotel occupancy tax in Pennsylvania?

Does PA Rev 1220 expire?

How do I fill out a Pennsylvania exemption certificate?

What is PA Rev 1220?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pennsylvania exemption certificate rev?

Pennsylvania Exemption Certificate REV refers to the revised version of the Pennsylvania Exemption Certificate. An exemption certificate is an official document used to claim exemption from sales or use tax on certain purchases. The REV version indicates that the certificate has been revised or updated to reflect any changes in the tax laws or requirements.

Who is required to file pennsylvania exemption certificate rev?

The entity or individual who is required to file a Pennsylvania Exemption Certificate Rev is the taxpayer or purchaser who wishes to claim an exemption from sales tax on certain purchases in Pennsylvania.

How to fill out pennsylvania exemption certificate rev?

To fill out the Pennsylvania Exemption Certificate REV-1220, follow these steps:

1. Download the form: Visit the Pennsylvania Department of Revenue website and download the REV-1220 form. Save it to your computer for easy access.

2. Begin with the taxpayer information: Fill in your legal name, business name (if applicable), mailing address, and residency status. If you are an individual, provide your social security number. If you are a business, provide your employer identification number (EIN).

3. Provide a brief description of your business/organization: Indicate the type of business or organization you are representing, such as a non-profit or government entity.

4. Indicate the type of exemption: Check the box that corresponds to the type of exemption you are claiming. There are different options available, such as specific industries, government entities, or non-profit organizations.

5. Specify the tax types you are exempt from: Check all the applicable tax types that you are exempt from, such as sales tax, use tax, or cigarette tax. If you are unsure, it is recommended to consult with an accountant or tax advisor.

6. Provide additional exemption details: If necessary, provide any additional details related to your exemption, such as the specific section of law or regulation granting the exemption.

7. Sign and date the form: Review the completed form for accuracy and ensure all required fields are filled in correctly. Sign and date the form at the bottom.

8. Submit the form: Once the form is completed and signed, you can submit it to the Pennsylvania Department of Revenue. The submission methods may vary, but you can typically mail it to the address provided on the form or submit it electronically through their online portal.

It is always advisable to consult with a tax professional to ensure accurate completion of the exemption certificate form based on your specific situation.

What information must be reported on pennsylvania exemption certificate rev?

The information that must be reported on Pennsylvania Exemption Certificate REV includes:

1. Name and address of the purchaser or organization claiming the exemption.

2. Type of exemption being claimed, such as sales tax exemption, use tax exemption, or both.

3. Specific reason or basis for claiming the exemption. This could include stating the nature of the purchaser's business or organization, or the specific statute under which the exemption is claimed.

4. Pennsylvania Sales and Use Tax License number, if applicable.

5. Purchaser's signature and date signed.

6. General description of the type of tangible personal property or services to be purchased.

7. A statement indicating that the purchaser will report and pay use tax directly to the Pennsylvania Department of Revenue if the exempt property is used or consumed in a taxable manner.

8. Any additional information or documentation required by the Pennsylvania Department of Revenue to support the exemption claim. This may vary depending on the specific exemption being claimed.

Where do I find pennsylvania exemption certificate rev?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the pennsylvania exemption certificate rev in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit pennsylvania exemption certificate rev in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing pennsylvania exemption certificate rev and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit pennsylvania exemption certificate rev on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share pennsylvania exemption certificate rev from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your pennsylvania exemption certificate rev online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.